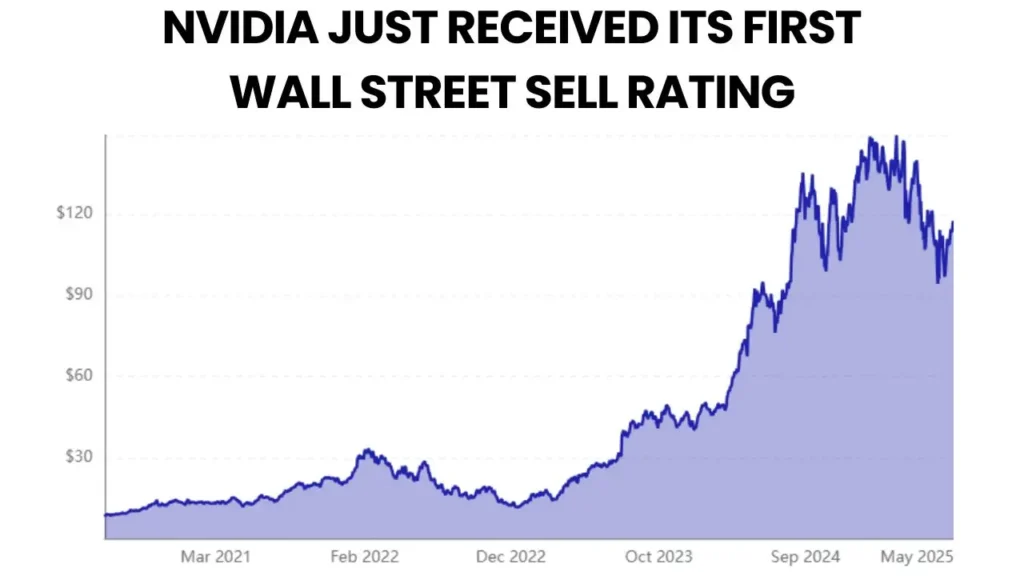

NVDA Stock Price: Nvidia (NVDA) has been a perennial favorite on Wall Street due to the company’s explosive revenue growth brought on by artificial intelligence (AI) and its strategic position in supporting next-generation data centers. However, with the recent surge in Nvidia’s stock price, a section of investors is questioning whether Nvidia’s growth trajectory can withstand emerging challenges. In this article, we will analyze Nvidia’s stock performance alongside its successes and the emerging factors which might impact the company’s growth.

Also Read: iQOO Neo 10 & 10 Pro: The Future of Smartphones

NVDA Stock Price: The AI Powerhouse

The name Nvidia is almost synonymous with AI now. Its data center GPUs, especially the H100 and Blackwell units, serve a critical role in AI-powered data centers, spurring considerable growth across gaming, cloud, and AI. Thus, as one of the most valuable semiconductor companies globally, Nvidia has transformed its sales from $27 billion in two fiscal years to $130 billion.

With this level of explosive growth comes deep scrutiny, however. Nvidia’s now surging stock price creates pressure on the company to deliver on increasingly lofty Wall Street expectations.

The stock price of Nvidia recently surged because of the greater demand for AI and machine learning technology. Nvidia GPUs emerged as the preferred hardware for new developments due to AI’s importance in nearly every technology field.

Nvidia is a darling among analysts, and the company tends to outperform projections which continue to propel its stock price. Nvidia’s stock price has skyrocketed in the last couple of years, and today stands at an all-time high. The consensus from analysts on Wall Street expects sales for fiscal 2026 to hit 201 billion dollars with a jump to 248 billion by 2027. Nvidia is enjoying an enviable position in the tech world because of the skyrocketing demand for their high-performance GPUs like Hopper and Blackwell.

The Hurdles Currently Confronting Nvidia

It is true that the company has recorded a remarkable success; however, not everyone is optimistic that Nvidia’s stock price will continuously increase. Analysts on Wall Street have started raising red flags regarding Nvidia’s growth. The primary issues are:

- Cap Restrictions

Nvidia seems to be handling the situation better than most firms, but it continues to face issues in meeting demand due to its insufficient supply capabilities. One of the critical players in the chip production ecosystem, Taiwan Semiconductor Manufacturing Company (TSMC), is working towards augmenting its capacity. However, the CoWoS (chip-on-wafer-on-substrate) approach used in AI data centers is still hindering Nvidia from achieving minimum sustained demand.

Since Nvidia has exhausted the order capacity for the Blackwell GPUs in fiscal 2026, coupled with competitors like AMD and Intel continuing to enhance their products, it will be increasingly difficult to meet the heightened expectations for product availability.

- Greater In-House Competition

The WFH policy has its advantages, but it has also intensified not-so-welcomed internal competition. Some of Nvidia’s biggest clients like Amazon, Google, and Microsoft have all started designing AI chips for their data centers, which serves as another factor to consider. While there is still demand for Nvidia’s equipment, the rise of in-house chips may pose a threat to the company. These bespoke components are often cheaper and more readily available, which could erode Nvidia’s dominance.

- AI Bubble Concerns

Despite the potential of AI, we have seen an increase in investment; however, long term industry analysts are predicting an eventual downturn as a lack of foresight from upper managment may lead to an “AI windfall” considerably hurting stock prices and earnings calls. Companies that have invested heavily in AI capabilities like Nvidia, now face rampant under estimation and over-reporting based off speculative assumptions due to no real investment in data accuracy to sustain the demands of executive fiat.

- Geopolitical Risks: Export Restrictions

Export restrictions placed by the US government have greatly disrupted Nvidia from selling overpowered AI chips to China. If things continue on this the downward slope, not only would other Chinese companies may face repercussions from the US, but also Nvidia will be left with no share in the world’s second biggest economy.

The Effect Of NVDA Stock Price Changes

Considering these challenges, several investors are raising concerns regarding Nvidia’s stock price. Nvidia remains an authority in the AI hardware industry; however, NVDA stock is presently priced at $2.9 trillion, which is a puzzling figure to justify in light of the company facing growth-slowing issues due to headwinds discussed above.

In late April, Port Research Partners’ senior analyst Jay Goldberg initiated a sell rating on Nvidia with a $100 price target, a considerable drop from where the stock is currently trading. Goldberg accepted Nvidia’s leadership position in the AI space, but believed stock-wise, Nvidia had already captured much of the potential growth.

NVIDIA Stock Price Conclusion

Over the last year, Nvidia has established itself as a prominent stock to keep an eye on in Wall Street. Rising valuations due to AI perpetuated growth has its barbie doll led by her pony tail which wont end well. Increasing production slogs; sod of blue-chip companies’ internal competition; geopolitical threats paired with simmering tensions and the looming specter of an AI bubble means Nvidia will have to tread very carefully with their stock price.

For investors, Nvidia remains one of the most complicated investments in the market. Will the stock price drop in value and correct itself or does Nvidia still have room to grow? Investors have had a long time to speculate on these questions, NVIDIA reporting its earnings for the first quarter on May 28. All eyes will be on NVIDIA’s next move and how they plan to sustain stock growth.